Title loan in-store payments offer a simple, secure, and immediate solution for borrowers using their personal vehicles as collateral. Unlike online loans with lengthy approval processes, these payments provide quick access to funds, ideal for urgent needs. By leveraging vehicle equity through titles, they ensure transparency and peace of mind while offering a straightforward, convenient financial experience, catering to both traditionalists and those lacking consistent internet access.

Title loans offer a unique financial solution, providing quick cash access secured by a vehicle title. In a digital age filled with online complexities, in-store payments for title loans stand out as a straightforward approach. This method simplifies the process, eliminating potential confusion associated with digital transactions. By visiting a physical location, borrowers can benefit from faster funding and personalized service, ensuring a transparent and hassle-free experience.

In this article, we explore why in-store payments are advantageous for title loan borrowers.

- Understanding Title Loans and Their Benefits

- The Advantages of In-Store Payments for Title Loans

- Streamlining the Process: How In-Store Payments Prevent Digital Disarray

Understanding Title Loans and Their Benefits

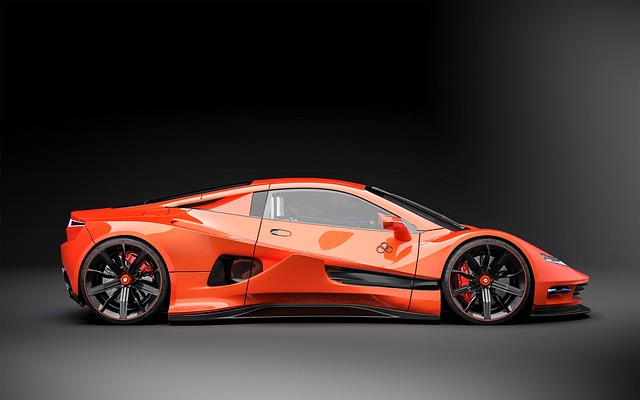

Title loans have emerged as a popular and accessible financial solution for many individuals facing short-term cash flow issues. This type of secured loan uses a person’s vehicle, typically a car or truck, as collateral, allowing borrowers to gain quick access to funds. The process is straightforward; applicants can complete an online application, providing details about their vehicle and personal information. Once approved, the lender will offer a loan amount based on the vehicle’s appraisal value, ensuring fast funding when compared to traditional bank loans.

One of the significant advantages of title loans is the flexibility they offer borrowers. In-store payments for these loans provide an alternative to online repayment methods, catering to those who prefer a more tangible approach to financial management. This option simplifies the process, especially for individuals new to digital banking or those without consistent internet access, ensuring a less confusing and more accessible way to manage their loan obligations.

The Advantages of In-Store Payments for Title Loans

In-store payments for title loans offer a multitude of advantages that can greatly simplify and enhance the borrowing process for individuals seeking quick cash. One of the primary benefits is the elimination of digital confusion. Many borrowers find themselves overwhelmed by the complex digital application processes, which often require multiple uploads of documents and detailed financial information. In-store options streamline this, allowing applicants to interact directly with lenders, clarifying any doubts and ensuring a better understanding of terms.

Additionally, in-store payments provide immediate access to funds. Unlike online loans that might take days for approval and disbursement, title loan in-store payments can be processed swiftly. This is particularly beneficial for those requiring urgent financial assistance, such as unexpected expenses or vehicle repairs, where time is of the essence. Moreover, these transactions are secure, utilizing the equity of one’s vehicle (including car title loans or truck title loans) as collateral, ensuring peace of mind for borrowers while offering a practical solution to their short-term funding needs, leveraging their vehicle’s equity through vehicle equity loans.

Streamlining the Process: How In-Store Payments Prevent Digital Disarray

When it comes to financial solutions like truck title loans or cash advances, a seamless and straightforward process can make all the difference. Title loan in-store payments offer a simple alternative to navigating the potential digital confusion often associated with online lending. By providing a physical location for transactions, these in-store options streamline the entire experience.

Unlike the complex procedures and hidden fees sometimes encountered online, in-store payments allow borrowers to understand the terms and conditions clearly. This transparency is crucial when seeking a financial solution. Whether it’s a quick cash advance or a more substantial truck title loan, customers can avoid the digital disarray by visiting a physical branch, ensuring a more secure and convenient experience.

In today’s digital age, simplicity and clarity are paramount. For individuals seeking title loan solutions, in-store payments offer a straightforward approach, eliminating potential confusion associated with online transactions. By choosing this method, borrowers can benefit from faster processing, reduced errors, and superior customer support, ensuring a stress-free experience. Title loan in-store payments streamline the process, providing a reliable and accessible option for those in need of quick financial assistance.